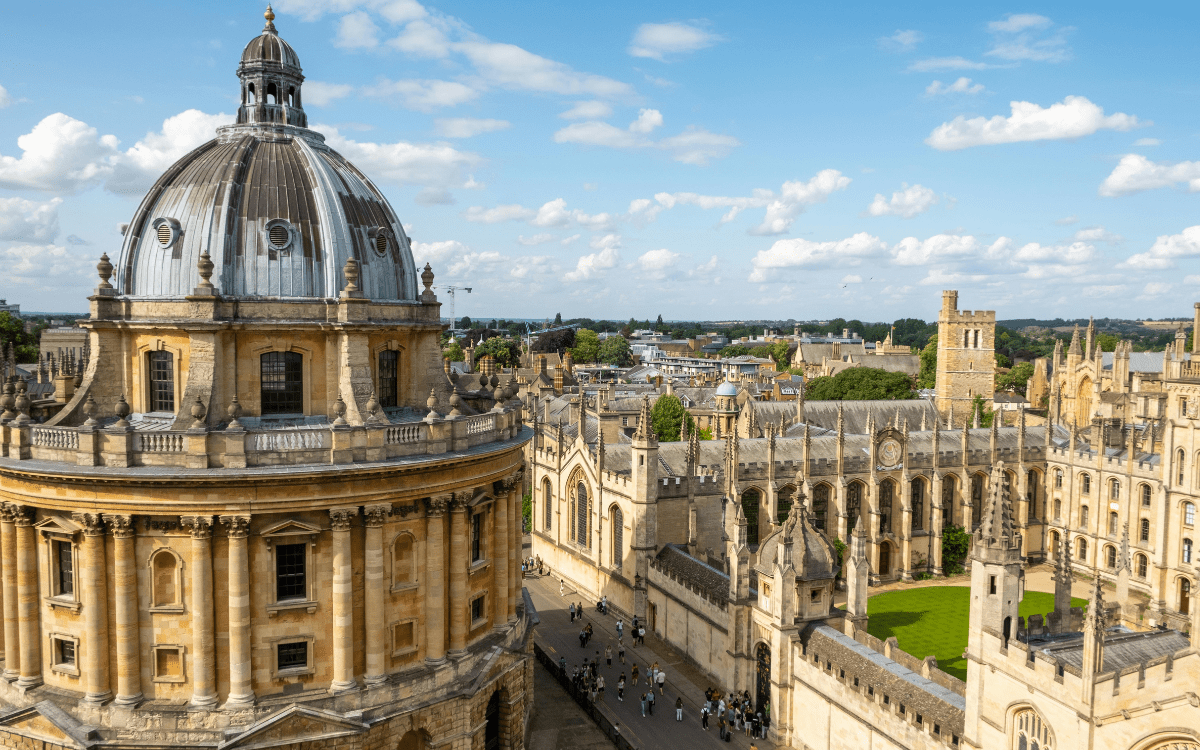

Dreaming of studying in the UK? Understanding the financial commitment is crucial for international students planning their educational journey. From university fees to daily living expenses, studying abroad in the UK involves various costs that require careful planning and budgeting. This comprehensive guide explores the financial aspects of UK education for international students, helping you make informed decisions about your study abroad experience. Understanding the Study Costs in UK The cost of studying in the UK varies significantly based on your choices. International students typically face higher expenses than domestic students, with costs differing dramatically between cities and institutions. Regional Cost Variations London and Southeast: Premium pricing across all categories Major cities: Moderate to high living costs with excellent universities Smaller university towns: More affordable options without compromising quality Location plays a crucial role in your overall study abroad budget. While London offers unmatched opportunities, cities like Manchester, Edinburgh, or Leeds provide excellent education at more manageable costs. UK University Fees and Academic Costs International students face different fee structures depending on their chosen programme and institution. University rankings, reputation, and programme specialisation all influence tuition costs. Program Types and Fee Ranges Undergraduate degrees: Fees vary by subject and university prestige Postgraduate programs: Generally higher than undergraduate, with significant variation Professional qualifications: Often premium-priced due to specialised nature Foundation programs: Entry-level programs with moderate fees Subject-Specific Considerations STEM subjects: Often higher fees due to laboratory and equipment costs Medical programs: Premium pricing reflecting intensive training requirements Business and MBA: Wide range depending on institution reputation Arts and humanities: Generally lower fees but still significant for international students Professional guidance becomes invaluable when navigating these complex fee structures and understanding the true value proposition of different programmes. Additional Academic Expenses Beyond tuition, international students must budget for various academic-related costs throughout their studies. Study Materials and Equipment Textbooks and digital resources Specialised equipment for certain courses Technology requirements (laptops, software) Field trips and practical experiences Professional Development Conference attendance Industry certifications Internship-related expenses Networking opportunities Living Expenses Across the UK Housing typically represents the largest portion of your living budget. International students have several accommodation options, each with different cost implications. University Accommodation Halls of residence: Often all-inclusive with utilities and internet Campus apartments: More independence with moderate pricing Catered vs self-catered: Significant cost differences to consider Private Accommodation Purpose-built student housing: Modern amenities with premium pricing House shares: Often the most economical option Studio apartments: Maximum independence at higher cost Homestays: Cultural immersion with moderate costs Location within cities significantly affects accommodation costs. Areas closer to universities or city centres command premium prices, while suburban areas offer better value. Daily Living and Personal Expenses Your lifestyle choices significantly impact daily living costs. International students must adapt to UK pricing while maintaining their quality of life. Food and Groceries Cooking at home: Most economical approach University dining: Convenient and flexible option Eating out: Occasional treat rather than regular habit Transportation Public transport: Essential for city living Student discounts: Significant savings available Cycling: Economical and healthy option Regional travel: Exploring the UK during studies Personal and Social Expenses Entertainment and social activities Clothing and personal items Health and wellness Communication with family back home Visa and Administrative Costs The UK student visa process involves several mandatory costs that international students must factor into their budgets. Essential Visa Costs Application fees: Non-refundable regardless of outcome Immigration Health Surcharge: Provides NHS access during studies Priority services: Optional faster processing for urgent applications Biometric appointments: Required for visa processing Pre-Arrival Administrative Expenses Several administrative costs arise before arriving in the UK, which students often underestimate. Documentation and Testing English language proficiency tests Academic credential evaluation Document translation and certification University application fees Pre-Departure Preparations Travel insurance Initial flight bookings Accommodation deposits Banking setup fees Students often benefit from professional guidance when navigating these complex administrative requirements, ensuring they don’t miss critical deadlines or requirements. Hidden Costs and Unexpected Expenses Pre-Arrival Surprises Many costs emerge during the preparation phase that international students don’t initially consider. Setup and Installation Costs Accommodation deposits: Often substantial upfront payments Utility connections: If not included in accommodation Essential household items: Setting up your living space Initial grocery shopping: Stocking your kitchen Travel and Logistics Airport transfers: Getting from airport to accommodation Temporary accommodation: If permanent housing isn’t immediately available Excess baggage fees: Bringing essential items from home Currency exchange costs: Converting money at unfavorable rates During-Study Unexpected Expenses Throughout your studies, various unexpected costs can arise that impact your budget. Academic Surprises Additional course materials: Specialised books or equipment Field trips and excursions: Educational but a bit costly experiences Conference attendance: Professional development opportunities Technology failures: Laptop repairs or replacements Personal and Health Expenses Medical costs: Beyond what NHS covers Emergency travel: Family situations requiring quick trips home Lifestyle adjustments: Adapting to UK climate and culture Social integration: Costs of building friendships and networks Managing Finances During Studies Banking in the UK Setting up proper banking relationships is crucial for managing your finances effectively. Account Types Student accounts: Special features and benefits International services: Multi-currency capabilities Online banking: Digital financial management Mobile apps: Real-time spending tracking Financial Services Currency exchange: Managing international transfers Overdraft facilities: Emergency financial cushions Credit building: Establishing UK financial history Investment options: Long-term financial growth Financial Wellness and Support Managing finances abroad can be stressful, and support systems are essential. University Support Services Financial advisors: Professional budgeting guidance Emergency funds: Hardship assistance programs Mental health support: Addressing financial stress Peer networks: Student financial support groups External Support Citizens advice: Free financial counseling Student organizations: Peer support and advice Professional services: Specialised international student support Online resources: Digital financial education tools Organisations specialising in international student support in UK can provide valuable guidance throughout your financial journey in the… Continue reading Study Abroad Costs UK 2025: Complete Budget Planning Guide

Study Abroad Costs UK 2025: Complete Budget Planning Guide